What are deductible expenses when selling your house?

Many people wonder whether the real estate agent’s costs for the sale of their home are deductible. Are you going to sell your house or have you just sold your house? Then it is nice to know which costs you did incurre are tax deductible.

Difference deductible costs k.k. and v.o.n.

A distinction must also be made in the purchase/sale. Namely whether the transfer is ‘costs buyer’ (k.k.) or ‘free by name’ (v.o.n.).

In the case of ‘free by name’ (v.o.n.), the selling party pays the costs of the transfer. The selling party has then incurred most of the deductible costs. However, ‘costs buyer’ (k.k.) apply much more often, so that you as a purchasing party incur more deductible costs.

Most deductible expenses can be found when purchasing a home. Unfortunately, there is not much tax benefit to be gained from the sale. To help you on your way, we simply explain in this article which costs are tax deductible and which are not when selling your house.

Below you will find a handy and brief overview of the deductible costs when selling a home:

| Cost | Deductible or not |

| Sales agent costs | Not deductible |

| Costs for applying for an energy label | Not deductible |

| Valuation costs related to the sale of your home | deductible |

| Costs for canceling the mortgage after the transfer of ownership | deductible |

Deductible mortgage repayment costs of the home

Mortgage repayment costs

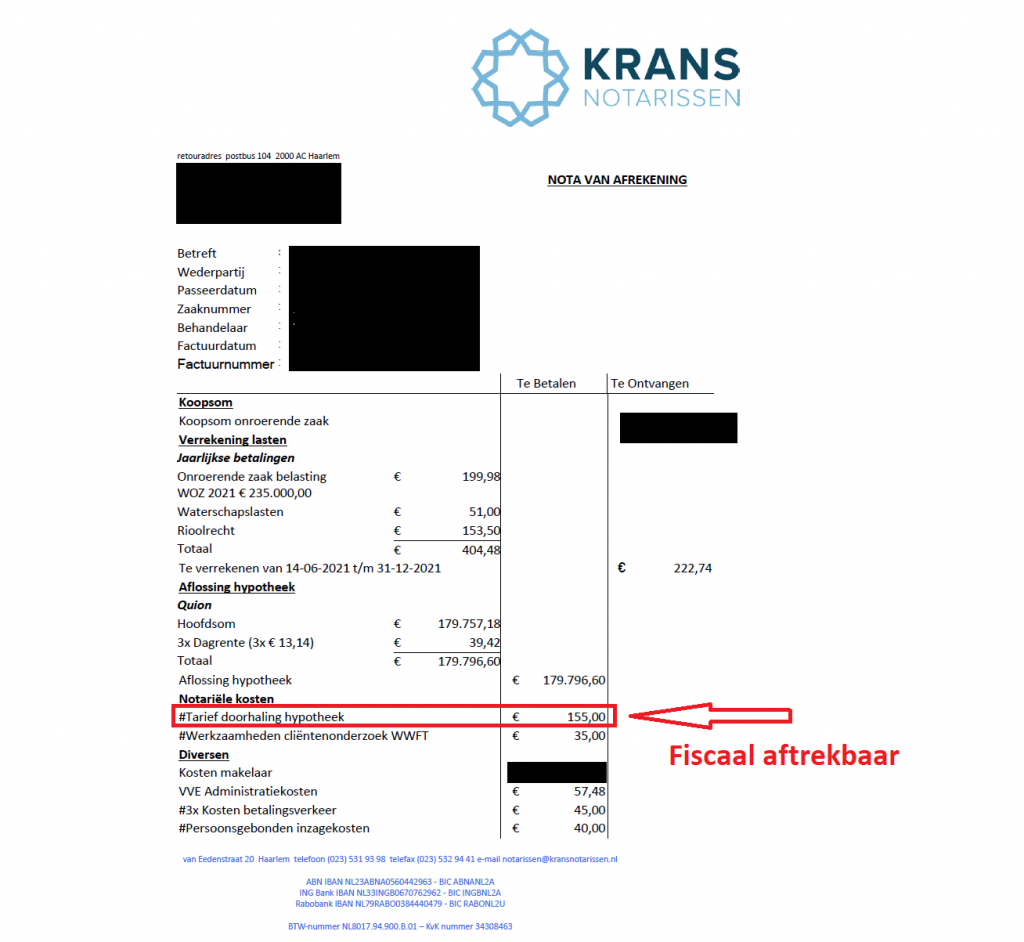

The costs for canceling (ruyement) of the mortgage are deductible. You will find this on the ‘bill of settlement’ that you receive from the notary before the key transfer. That looks like this:

Deductible costs of the valuation

You may also have to have a valuation report drawn up of your current house for the purpose of financing the house you have bought. The costs for this valuation report are therefore tax deductible.

So make sure you keep these invoices well and declare these costs as a deductible item in your annual income tax return!

Which costs are not deductible when selling your home?

Above we have already discussed all costs that are deductible when selling your home. All following costs are therefore NOT deductible when selling your home:

– Brokerage fees

-Cost for sales photos and other media files

-Marketing costs (such as Funda)

-Costs for the energy label

-Costs for Funda

-Costs for the notary

– Any costs for repairs or other costs to prepare the house for sale

Pay tax on the profit I make on my house?

The amount that you have left after paying off the mortgage and after deduction of all costs is untaxed. You do not pay tax on this profit. If you put that money in your savings account, you will of course only pay the capital gains tax on your savings.

And pay attention: if you have bought a new home, you must put the ‘profit’ from your old home into your new home. If you do not do this, you may not deduct 100% of your new mortgage costs for tax purposes.

Deductible costs for debt after sale

Since 2018, the interest on the loan taken out to pay residual debt is no longer deductible. It is possible to include the residual debt in the mortgage of your new home. You pay the residual debt monthly over a longer period instead of in one go.

Deductible costs for new construction

Are you going to buy a new-build home? Then slightly different tax rules apply. You always buy a new-build home ‘Free by Naam’, abbreviated: V.O.N. This means that the selling party (the project developer) pays the notary costs and you do not have to pay notary fees to be able to deduct tax.