Fiscal Advise

Blog category

Why you can no longer get rental housing and what the solution is (simply explained)

Currently, in much of the Netherlands, it is almost impossible to get rental housing. The rental market has really totally exploded. Hundreds of thousands of people, out of desperation, no longer know what to do to get rental housing, and it seems to be getting even...

Are purchase agent fees deductible?

Bij het kopen van een huis zijn er een aantal kosten die aftrekbaar zijn van de belasting. Denk hierbij aan de hypotheekrente, notariskosten en de taxatiekosten. Maar hoe zit het eigenlijk met de kosten van een aankoopmakelaar? Deze kosten zijn helaas niet aftrekbaar...

Can you transfer money to the notary earlier in order to have less equity on Dec. 31?

Suppose you bought a house and the transfer isn't until Jan. 15. You will contribute €150,000 of your own funds. It is December 30. You actually want to quickly transfer that €150,000 to the notary's third-party account so that when you file your tax return later, you...

What sales price may I use if I want to sell a rental property to my child?

In this blog, we have already explained to you how to sell a house to your child as cheaply as possible. But what about if you want to sell a rental property to your child? We explain it to you simply here. If you have a property either residential or commercial that...

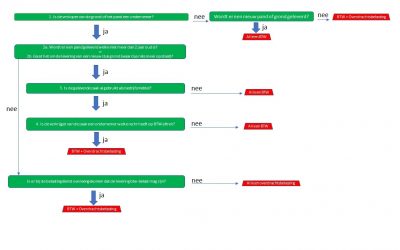

When is there transfer tax and when is there VAT?

When is there transfer tax and when is there VAT? When buying/selling a piece of land, a newly built home, an existing home or a home under construction, the question often arises of what taxes need to be paid. Sometimes transfer tax must be paid, sometimes VAT must...

What should you still believe about the housing market?

Over the past few months, we have definitely seen a drop in bids on homes we have sold. The number of viewings has also declined significantly. Mainly due to the rise in interest rates, for a variety of reasons. We have successfully purchased several properties in the...

Which costs are deductible when selling your house?

Cost Deductible or not Sales realtor costs Not deductible Costs for applying for an energy label Not deductible Appraisal costs related to the sale of your home Not deductible Costs for canceling the mortgage after the transfer of ownership Deductible Cost...

What expenses are deductible when you buy a home?

When buying a home, you incur many expenses. The real estate agent, obtaining the mortgage, the notary, the land register, etcetera. But exactly what costs of this are tax deductible? Below you will find a clear overview of the costs that are and are not deductible...

When and how do you get a transfer tax refund?

When reselling your home, you can use thetransfer tax 'get back'. The rule is that onlytransfer tax must be paid on the capital gain of the property ifthe property gets a new owner within 6 months. Please note that who is entitled to this 'benefit' mustyou agree in...

What costs should you consider when buying a home?

What is striking is that many websites give too rosy a picture of these costs. A purchase broker does not cost €2000 and a notary does not cost €500 (source: website Hypotheker). These are rates that do not occur in real life in most regions. An important piece of...