When to pay an appraisal/appraiser is a crucial question when hiring an appraiser for a professional valuation of your home. The process of an appraisal involves several aspects, including the timing of payment. In this article, we explore the important issues surrounding when to pay an appraiser. Read on soon!

When to pay an appraiser: before, during or after the appraisal?

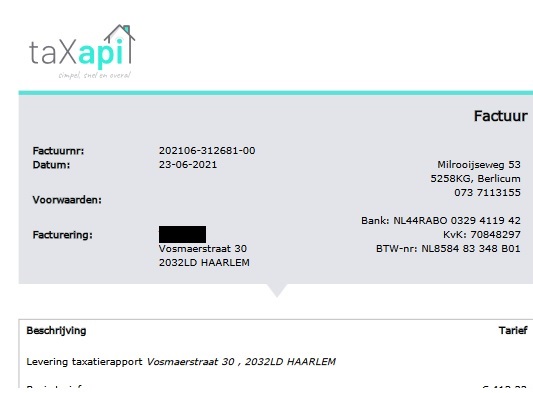

When you have to pay the appraiser depends on what you agreed to. Is the appraisal for obtaining or changing a mortgage loan? Then the appraisal is often paid through the notary. The invoice you or your mortgage advisor receives will be forwarded to the notary where the mortgage or modification (refinance, remodel, etc) in the mortgage is officially done.

The notary draws up 1 final statement in which the costs of the appraiser are then included. As a result, payment to the appraiser sometimes does not occur until a few months after the appraisal report is issued.

In most other cases, payment from the appraiser is made via an iDeal payment to the appraiser before one can download the report. Once the appraisal report is ready , the client automatically receives an email with a payment link. After payment, one can download the appraisal report.

In short, some appraisers require payment before the appraisal, while others accept payment after completion of the appraisal. It is important to discuss these details in advance with the appraiser and set out the payment terms in a written agreement.

Factors affecting the cost of an appraiser

Several factors can affect the cost of an appraiser, including the complexity of the house, the location, the expertise needed and the reputation of the appraiser.

You can also save costs by, for example, comparing quotes from different appraisers, choosing a local appraiser to reduce travel costs and asking about any discount opportunities.

The importance of an independent appraiser

An independent appraiser plays a crucial role in the valuation process and is essential for a good appraisal. So you need an expert appraiser who knows the market well, has experience with similar homes and can provide accurate and reliable appraisal reports.

By paying for a professional appraiser, you minimize the risk of under- or overvaluing the house, which is important in negotiations, mortgage applications and insurance.

Want to know more about appraisals? Check out all of our blogs about appraisals here! Are you interested in an appraisal or would you like more information about it? Please feel free to contact us if you have any questions or need help with your home appraisal. Together, we can ensure that you can make an informed decision about your mortgage and your home.