You can get additional mortgage loans as a (new) homeowner to finance a remodel.

A remodel can be very small (such as a new kitchen) or it can be turning the house upside down and wanting to tackle everything in the home. Maybe there is nothing wrong with the home, but you want to make it more sustainable with solar panels, for example.

Whatever you want to invest, in most cases you can borrow (extra) money for this from your mortgage bank.

To get this loan, in most cases the bank will want to see an appraisal value after remodeling in a validated (=official) appraisal report. We go into more detail in this article about everything surrounding the appraisal value after a remodel, so read on soon!

What is the assessed value after remodeling?

By default, an appraisal report states the market value of the home in its condition. We call this the market value. This is the estimated value the home would fetch in the current market at that time if sold with decent marketing.

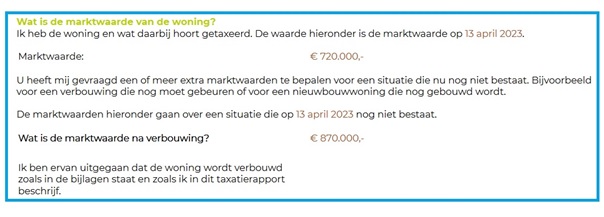

In addition to this existing market value, an appraiser can also calculate what a home is worth if a particular renovation has taken place. This is listed as a second value in the appraisal report and this is the assessed value or market value after remodeling. You can see what this looks like in the image below.

What does appraisal value after remodeling look like in an appraisal report

In an appraisal report, it looks like this:

What should I arrange if I want to finance a remodel with (additional) mortgage loan?

Contact your financial advisor and explain your plans to him/her.

- Complete this remodeling specification. Here is an example of a completed remodeling specification.

- Mail the completed remodel specification to your financial advisor.

- Ask the financial advisor if you need an appraisal report with a post-reconstruction value. Sometimes a normal appraisal report with just the current market value is enough. This is often the case when one already has a lot of excess value on one’s home.

- If you need an appraisal report, find an appraiser who can do an appraisal report for you. Nb: if you need an appraisal report in 1 of the following places, we can give you also help with this: Aalsmeer, Amstelveen, Amsterdam, Badhoevedorp, Bakkum, Beverwijk, Bloemendaal, Castricum, Cruquius, De Kwakel, Driehuis, Haarlem, Halfweg, Heemstede, Hillegom, Hoofddorp, IJmuiden, Koog aan de Zaan, Krommenie, Lisse, Nieuw-Vennep, Oostzaan, Overveen, Santpoort-Noord, Santpoort-Zuid, Spaarndam, Uitgeest, Velserbroek, Vijfhuizen, Vogelenzang, Westzaan, Wormer, Wormerveer, Zaandam, Zaandijk, Zandvoort and Zwanenburg.

- Mail the appraiser the remodeling specification you prepared in step 1.

How does the appraiser calculate the assessed value after remodeling?

The appraiser will need to find at least 3 comparable reference homes from which to demonstrate the market value after remodeling. Ideally, of course, these are exactly the same homes as that of the property being appraised with the planned improvements. But the practice, unfortunately, is often that 100% comparable reference objects are not always available. This is why an appraiser is going to scrutinize as many reference homes as possible and find pluses and minuses from the different value aspects that each home has. Value aspects can include living area, plot area, level of finish, location, outbuildings, et cetera.

Does the appraiser think my budgeted remodeling costs are realistic?

Pay close attention that the appraiser must also give his/her opinion in the appraisal report as to whether the remodeling costs you specify are realistic. We experience very regularly that people in a handyman’s house think they can renovate a kitchen for €3500 and a bathroom for €6000. Those are just not realistic budgeted amounts.

Therefore, be sure to get good information in advance about realistic remodeling costs for each building component in the home. Also hire a good appraiser who is willing to look and think with you in advance regarding the budgeted remodeling costs. After all, you should avoid having the appraiser’s appraisal report indicate that your budgeted remodeling costs are unrealistic. In fact, this could lead to the bank rejecting a loan.

How much will my home’s value increase because of remodeling or preservation?

To give an obvious example right away. A house with a modern blue kitchen a year old, will not become worth more if you invest €15,000 in the same modern kitchen in red. Things that add value include:

-If you can add living space (addition, dormer, roof addition, ridge increase, et cetera)

-If you address poor maintenance and thereby increase the maintenance condition of the home

-If you are going to modernize dated a kitchen and/or bathroom

-If you are going to invest in sustainability (improve energy performance)

-If you are going to modernize a dated home to today’s requirements

It really varies a lot from case to case how much value is going to be added by the appraiser’s estimate and substantiation. The image a bit above is from 1 of our appraisal reports. You can see in it that the current market value is €720,000 and the market value after remodeling is listed at €870,000. This involved the appraisal of a shell house with nothing in it (no kitchen, bathroom, floors, walls and ceilings) and where the window frames were completely rotten. The client here was going to invest €150,000 in a remodel to modernize/modern rebuild everything. In our view, the €150,000 investment added 100% value to the appraised property, and so did the references we analyzed.

Ask the appraiser for help with your remodel specification

It is not here to factually determine when a modification or addition to a property provides for a higher value of that property and by how much. What you could do, however, is to take a moment beforehand to review the remodeling specification you completed with the appraiser and ask him/her if he/she can provide an estimate of the value effect of your budgeted remodeling and preservation plans.

Then ask right away if the appraiser thinks the budgeted amounts in the remodeling specification are realistic. Just keep in mind that not every appraiser is willing to think and help with this. Nb: with us, by the way, you can ALWAYS count on our help with your remodeling specifications. Contact us today and receive expert advice for your remodeling plans. We are here to help you create realistic budgets and understand the value effect of your remodel. Don’t hesitate and request a free consultation now!