If you need an appraisal to obtain financing for a home, in 99% of cases you will need an NWWI VALIDATED appraisal report. This means that an independent institute (the NWWI) checks the appraiser’s valuation report and sees if it meets all the requirements and guidelines. Banks would like to see a validated report.

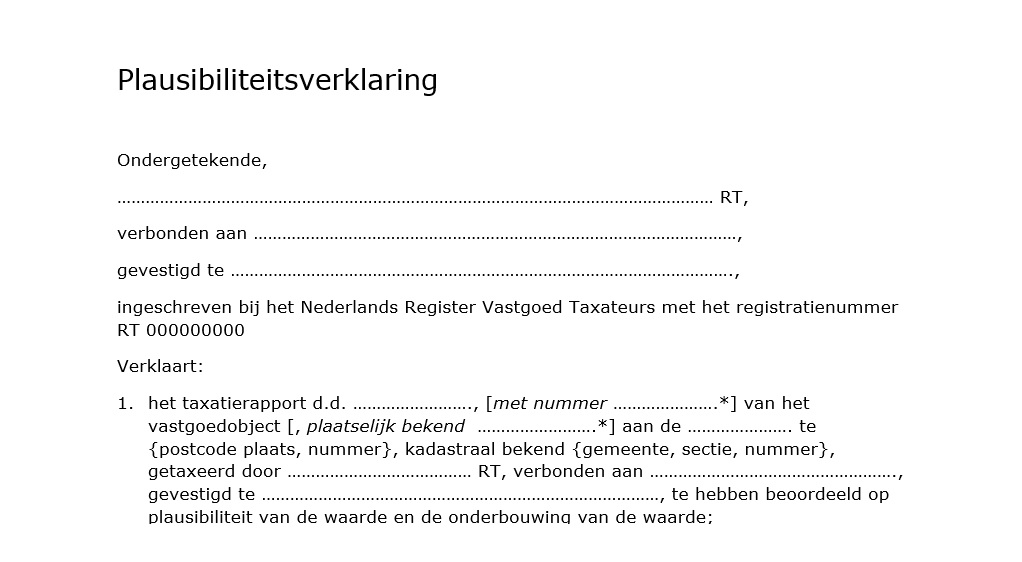

However, some appraisals cannot be validated. We’ll come back to the situations in which that applies later. If an appraisal report cannot be validated, the Netherlands Register of Real Estate Valuers (“NRVT”) states that an appraisal report must be reviewed by a2nd independent appraiser. This2nd reviewing appraiser reviews his colleague’s appraisal report and when agreed signs a plausibility statement. This plausibility statement looks like this.

The definition of a plausibility statement in appraisal

Thus, a plausibility statement to an appraisal is a statement issued by an appraiser to strengthen the substantiation and reliability of the appraisal value. It is an additional document that is added to the appraisal report and serves to refute possible doubts or questions from interested parties.

The statement provides additional assurance to mortgage lenders, financial institutions or other concerned parties, for example. It gives them confidence that the appraisal value has been determined correctly and objectively.

When is a plausibility statement required? / Which appraisals cannot be validated?

In the following situations, a plausibility statement is required and therefore these reports cannot be validated by the NWWI:

Non-validatable appraisals:

- Recreational property not intended or used for personal use

- Recreational property where there is a rental obligation

- Company real estate with a residence to be occupied only by the company associated persons.

- Agricultural real estate (in most cases)

- Residential trailers (in most cases)

- Chalets (in most cases)

- Houseboats, houseboats, houseboats and water villas unless

- There is a permanent mooring and

- is a long-term mooring permit and

- there is a piece of land (with or without superficies or long leases) with the house

- Room rental properties

- Properties that are not cadastrally subdivided and have more than one tenant (for example, an upstairs apartment with a rented apartment on the1st floor as well as a rented apartment on the2nd floor where this upstairs apartment is not cadastrally subdivided).

Need an appraisal?

If you have an appraisal done and want to add extra assurance and credibility to the report, consider asking for a plausibility statement. This can be invaluable in gaining confidence from mortgage lenders or financial institutions. Do you need an appraisal? Then we can help you with this! That way we can also discuss right away the possibilities of adding a plausibility statement to your appraisal report. You’ll also find helpful blogs regarding appraisals where we answer frequently asked questions. Contact us without obligation by filling out the form or call Floris at 06-47470404.