You may well have an appraisal report done on a property and there are 2 appraised values in that report. And then there is probably a big difference between those 2 appraisal values.

We’ll explain why that is.

For this reason, there are often 2 values in your appraisal report

The appraiser MUST appraise the property in the condition as he finds it. It is often the case that there are still tenants is the property. This means that at that time, that property is also a rental property and should also be valued as a rental property. We call this first value here “VALUE 1.

But you probably bought this property to live in by yourself. And your bank is going to leave you financing based on an unrented property. Therefore, the appraiser is also going to calculate the “normal market value” for you. That is, the value of that property without tenants in it. We call that here in this example “VALUE 2.

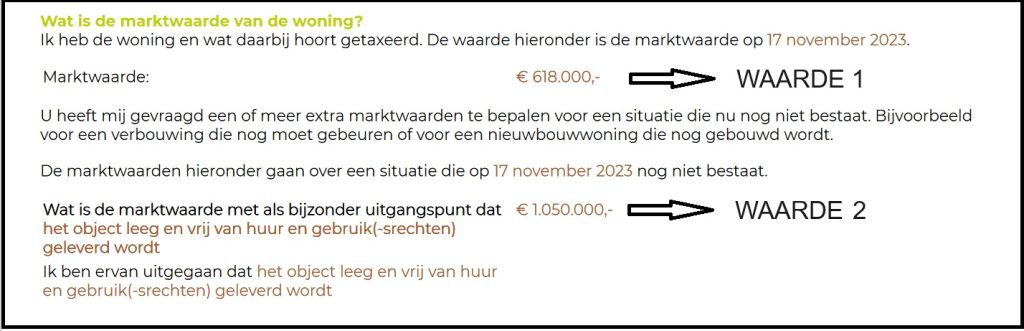

Below is a screenshot from such an appraisal report. Our clients had purchased this property but the property was still being rented when we came to appraise it.

That means we first calculate and write down a value in rented condition (value 1) and only then calculate the property in unrented condition (the “normal” appraisal value – value 2).

How does this lower appraisal value affect my bank or mortgage?

If you bought a property that is transferred to you free of rent and use (i.e., in an unrented state), it will not affect your mortgage or interest rate. In principle, a bank does not do anything with the1st value in rented condition as long as the property is handed over to you unrented and you are actually going to live in that property yourself. Make sure that the purchase agreement clearly states that the property is “delivered to you rent free. So that you don’t accidentally buy a property that will be delivered to you rented.

Rented out property and still market value free of rent as2nd assessed value

But it can also be the other way around. You may have an appraisal report of a rental property appraised and that property is simply rented and remains rented. Yet you notice that there are still 2 appraisal values in the appraisal report again namely:

Value 1: the value in rented condition

Value 2: the assessed value of the property without a tenant in it

Actually, that2nd value is not needed at all, yet the appraiser is required to include it. Nothing more and nothing less. This has no consequences for you.

Other reasons that there may be a2nd assessed value in an appraisal report.

One of the most common reasons why there are otherwise 2 appraisal values in an appraisal report is because people want to remodel. The appraiser must then calculate the value before remodeling (i.e., the current state) and a value after remodeling.

But in addition, there can be many other reasons of a2nd appraisal value. We call these “special principles.

Examples of special valuation principles

For example, one needs to know what the property is worth if:

-A new construction home is completed

-The ground lease will be converted to full ownership

-A piece of land will be purchased in addition

-There is an adjacent garage or parking space purchased with the home

-The zoning plan has been converted

-And so on…

Need help with an appraisal?

Hopefully this information will help you. Are you interested in an appraisal or would you like to receive more information about appraisals?

Please feel free to contact us if you have any questions or need help with your home appraisal. Together, we can ensure that you can make an informed decision about your mortgage and your home.